What is Marked Price, Discount, and VAT?

Marked Price

The price which is listed or printed on

the item or article for sale is called the marked

price or labeled price of the item. It is denoted by MP.

Discount

When a shopkeeper reduces a certain amount from the marked

price of an article and sells it to the customers, the reduced amount is called a discount. Discount usually is given as

a certain percent of the marked price.

Thus,

Actual Selling Price (SP)

The price of goods after deducting the

discount amount from the marked price (MP) is called the actual selling price or SP.

Thus,

SP = MP – Discount amount

VAT (Value Added Tax)

VAT (Value Added Tax) is a

government tax levied on the cost of certain goods or services. The VAT rate is

usually in percent and is decided by the government. The rate of VAT varies

from country to country and there are certain goods and services which are free

from VAT. For example, educational items, social welfare services, etc. are

VAT-free goods and services.

VAT is levied on the actual selling price SP.

Thus,

SP with VAT

The final price of goods after deducting

discount amount (which is SP) and adding the VAT amount is called SP with VAT.

Thus,

SP with VAT = SP + VAT amount

What about CP?

CP is the cost price of the item for the seller (shopkeeper). Then, the shopkeeper marked the price of that item higher than the cost price. So, CP always is less the MP. Therefore, by giving a discount also, a shopkeeper makes a profit in his business.

Since VAT is the tax paid by the customer to the government. This amount is not calculated for profit or loss.

For more details on CP, SP, Profit and

Loss and their formula, please go to the article - Profit and Loss!

Formula List

Here is the list of all formulas on MP, Discount, SP, and VAT.

********************

10 Math Problems officially announces the release of Quick Math Solver and 10 Math Problems, Apps on Google Play Store for students around the world.

********************

********************

Worked Out Examples

Example 1: The marked price of a book is Rs. 200. If a discount of 10% is

offered. Find the selling price of the book.

Solution:

Here,

MP = Rs. 200

Discount = 10%

SP = ?

We know,

∴ The selling price of the

book = Rs. 180.

Example 2: The marked price of a computer is Rs. 30000. If it is sold after

20% discount and then 30% VAT is levied on it. Find the price of the computer

including VAT.

Solution:

Here,

MP = Rs. 30000

Discount = 20%

VAT = 13%

SP with VAT = ?

We know,

∴ The price of the computer

including VAT = Rs. 27120.

Example 3: After allowing a 15% discount on the marked price of a radio, 13% VAT

is levied, then the cost of the radio becomes Rs. 1997. Find the marked price of

the radio.

Solution:

Here,

SP with VAT = Rs. 1997

Discount = 15%

VAT = 13%

MP = ?

We know,

∴ The marked price of the

radio = Rs. 2080.

Example 4: The marked price of an article is Rs. 5000. After allowing some

percent of discount and adding 10% VAT, the article is sold for Rs. 4400. Find

the discount percent.

Solution:

Here,

MP = Rs. 5000

SP with VAT = Rs. 4400

VAT = 10%

Discount % = x% (let)

We know,

∴ Discount percent = 20%

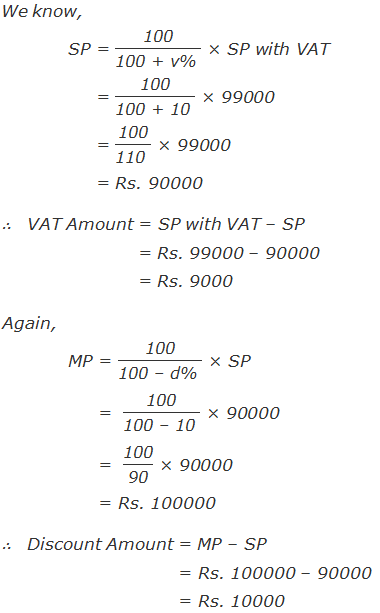

Example 5: A machine is sold at Rs. 99000 after 10% discount and 10% VAT on

the marked price. Find the discount amount and VAT amount.

Solution:

Here,

SP with VAT = Rs. 99000

Discount = 10%

VAT = 10%

Discount Amount =?

VAT Amount = ?

∴ The discount amount is Rs.

10000 and VAT amount is Rs. 9000.

Example 6: After allowing a 20% discount on the marked price and then levying

10% VAT, a radio was sold. If the buyer had paid Rs. 320 for VAT, how much was the

discount?

Solution:

Here,

Discount = 20%

VAT = 10%

VAT Amount = Rs. 320

We know,

VAT Amount = VAT% of SP

∴ Rs. 800 was the discount amount.

Example 7: A shopkeeper allowed a 10% discount on a watch of marked price of Rs.

600. If he got 8% profit, find the cost price of the watch.

Solution:

Here,

MP = Rs. 600

Discount = 10%

Profit = 8%

CP = ?

∴ The cost price of the watch = Rs. 500.

Example 8: Davish sold a watch at a gain of 20% after allowing a discount of 15%.

Had it been sold after allowing a 30% discount, there would have been a loss of

Rs. 400. Find the marked price of the watch.

Solution:

Here,

MP = Rs. x (let)

∴ The marked price of the watch is Rs. 48000

Example 9: When an article is sold at a discount of 10% on its marked price, a

profit of Rs. 8 is earned by the seller. If the same article is sold without

allowing a discount there will be a profit of Rs. 20. What should be the cost

price of the article?

Solution:

Here,

CP = Rs. x (let)

∴ Cost price should be Rs. 100

Example 10: The marked price of an article is 25% above the selling price and

the cost price is 20% below the selling price. Find the rate of discount and

the profit percentage.

Solution:

Here,

SP = Rs. x (let)

Marked price is 25% above the selling price,

Again,

Cost price is 20% below the selling price,

∴ Discount = 20% and Profit = 25%.

The lebelled price of a radio is Rs 5210. If the shopkeeper allows 10% discount and adds 10 % VAT then,

ReplyDelete(i) How much will a customer pay for the radio

(ii) Find the difference between marked price and selling price

Here is the solution to your problems,

Delete[image src="https://1.bp.blogspot.com/-OFNH4wAyeUI/YBANRVpvq_I/AAAAAAAAHaE/G_dqWX5adygxeMDgK3TYxIot-3upgCgbACLcBGAsYHQ/s598/comment%2B-%2Bsolution%2B1.png"/]

Comment here, if you have more problems regarding marked price, discount and vat.

Reasonableness: While protection rates have expanded at twofold digit rates in the course of recent years, discount card suppliers have kept their rates for all intents and purposes unaltered. Coupons

ReplyDeletethe mp of a laptop is rs.75000. after allowing a certain percent of discount and including 15%VAT, the laptop is sold at rs.73312.5.calculate the discount percent and VAT amount

ReplyDeleteHere is the solution to your problems,

Delete[image src="https://1.bp.blogspot.com/-6GL598P5ZEM/YGXk2d9pkKI/AAAAAAAAIBQ/pQCjpL-oW14WbBHydF4iGblUFzhxiUe3wCLcBGAsYHQ/s16000/Comment%2BSolution%2B2.png"/]

Comment here if you have more problems regarding marked price, discount and vat.

the marked price of an article is rs 10000 and the shopkeeper allows some percent discount and adding some percent vat which is 3% more than the discount percent. if the customer pays rs. 10170 for the article then find discount percent

ReplyDeleteHere is the solution to your problems,

Delete[image src=" https://1.bp.blogspot.com/-3jeSIOW6Juo/YHW7YahTdWI/AAAAAAAAIEg/JRuYw3UvG586bm6rLFCYK7IQSmr6cAcvQCLcBGAsYHQ/s16000/comment%2Bsolution%2B3.png "/]

Comment here if you have more problems regarding the marked price, discount and vat.

A watch costs rs 8136 when it is 10% discouted and 13% of vat is added then find out discount and vat amount. By how much vat amount is more than the discount amount? Can u solve this one for me.

ReplyDeleteHere is the solution to your problems,

Delete[image src=" https://1.bp.blogspot.com/-o5cLawp7J14/YIGHgzEo9WI/AAAAAAAAIJw/BdurmLPT_ZAwVv5w9vcSSUXlzBDRnuhWwCLcBGAsYHQ/s16000/comment%2Bsolution%2B4.png"/]

Comment here if you have more problems regarding the marked price, discount and vat.

After allowing 10% discount on the marked price of a cycle 13% vat was levied and sold it.If the differences between the selling price with vat and selling price after discount is rs 585,find the marked price of that cycle

ReplyDeleteHere is the solution to your problems,

Delete[image src="https://1.bp.blogspot.com/-zXxv542WyjM/YJkcba1J-mI/AAAAAAAAIh0/c7nPUr9UqXAUcB53Q0D_S4Nug4_19z_4QCLcBGAsYHQ/s16000/comment%2Bsolution%2B5.png"/]

Comment here if you have more problems regarding the marked price, discount and vat.

A shopkeeper selling an article at a discount of 20% loses Rs. 200. If he allows 10% discount he gains Rs. 150. Find MP and the cost price of the article.

ReplyDeleteHere is the solution to your problems,

Delete[image src=" https://1.bp.blogspot.com/-5jZxNe_QBRo/YKSSf6neKNI/AAAAAAAAImA/0BZYnQ8VcTYgW8kAVeInGGfvMarrGGI9ACLcBGAsYHQ/s16000/comment%2Bsolution%2B6.png "/]

Comment here if you have more problems regarding the marked price, discount and vat.

If M.P of an article is Rs.8000. And if discount rate and VAT rate are equal and the price with VAT is Rs.7,864.80 find discount rate

ReplyDeleteHere is the solution to your problems,

Delete[image src=" https://1.bp.blogspot.com/-63FWkSy9sSU/YLB90J4tOGI/AAAAAAAAIwY/ArgV9hOEtnQPB3RewG9szCvy0Ja3c0PmQCLcBGAsYHQ/s16000/comment%2Bsolution%2B7.png"/]

Comment here if you have more problems regarding the marked price, discount and vat.

If an article is sold at 25% discount,the profit is 10%.If the discount is 10% only,the profit is Rs.240, find the marked price of the article.

ReplyDeleteHere is the solution to your problems,

Delete[image src=" https://1.bp.blogspot.com/-Ah7gE9ULSG8/YLiMfTNEcgI/AAAAAAAAI7A/LWsoMBLKXFQuU5AM6QabfTqWA913Vl_JgCLcBGAsYHQ/s16000/comment%2Bsolution%2B8.png"/]

Comment here if you have more problems regarding the marked price, discount and vat.

The price of a cycle after allowing 15% discount and 13% VAT is Rs.19,323. Find the amount of VAT levied and marked price.

ReplyDeleteHere is the solution to your problems,

Delete[image src="https://1.bp.blogspot.com/-RqYVlYTpUqo/YNrPH5PkkaI/AAAAAAAAJV4/VRkNpOUiyk4fHc97YGDYnFoex9s3CEYjQCLcBGAsYHQ/s16000/comment%2Bsolution%2B9.png"/]

Comment here if you have more problems regarding the marked price, discount and vat.

A shopkeeper marked the price of a article a certain percent above the cost price and he allowed 16℅ discount to make 5℅ profit. If a customer paid Rs.9492 with 13℅ vat to buy the article. By what percent is the MP above the CP of an article.

ReplyDeleteHere is the solution to your problems,

Delete[image src="https://1.bp.blogspot.com/-3cz330vNCpY/YNxPTLszucI/AAAAAAAAJWA/iW2n8PycpKYAyorsfpD5Q_L65b58m7AsgCLcBGAsYHQ/s16000/comment%2Bsolution%2B10.png"/]

Comment here if you have more problems regarding the marked price, discount and vat.

hi was just seeing if you minded a comment. i like your website and the thme you picked is super. I will be back. promo

ReplyDeleteSome truly nice and utilitarian info on this internet site , besides I think the layout holds wonderful features. BTC Analysis and News

ReplyDelete13% VAT is levied on a handicraft after 10% discount. If the VAT amount is Rs 910,

ReplyDeletethen find the marked price and selling price of it with VAT.

Here is the solution to your problems,

ReplyDelete[image src="https://1.bp.blogspot.com/-3KGmtaZpZjo/YOAeBP1jmCI/AAAAAAAAJYE/kmV8uAbB-Cg9cK2k10sZTeiglPxYQQB3QCLcBGAsYHQ/s16000/comment%2Bsolution%2B11.png"/]

Comment here if you have more problems regarding the marked price, discount and vat.

A shopkeeper has to pay 7% bonus for selling some goods if he paid rs 17500 bonus and then 13% vat what will be marked price and price including VAT

ReplyDeleteHere is the solution to your problems,

Delete[image src="https://1.bp.blogspot.com/-TLUwt1qWCfA/YOQS5or01gI/AAAAAAAAJZs/_Zz4f8DwScsmRo7Ps785aUrEA0sXhxDIACLcBGAsYHQ/s16000/comment%2Bsolution%2B12.png"/]

Comment here if you have more problems regarding the marked price, discount and vat.

Sonia sold a machine of price Rs150000 adding 13percent Vat to Binod. Binod sold it to Enjila by adding transportation cost Rs4000, profit Rs7000 and Rs1500 local tax. If Enjila has to pay 13percent vat, find Vat amount.

ReplyDeleteHere is the solution to your problems,

DeleteSolution: Here,

Price of machine = Rs. 150000

Price with transportation + profit + local tax,

= Rs. 150000+4000+7000+1500

= Rs. 162500

VAT = 13%

VAT amount = 13 % of Rs. 162500

= 13/100 × 162500

= Rs. 21125

A dealer of electric oven sold an induction heatet at Rs.4,200 with 13% VAT to a retailer. The retailer added transportation cost of Rs.250, profit 15% and local tax Rs.150 and sold to a costumer. How much will be paid for that heater if he/she has to pay 13% VAT

ReplyDeleteHere is the solution to your problems,

DeleteSolution: Here,

Price of heater = Rs. 4200

Price with transportation + profit + local tax,

= Rs. 4200+250+15% of 4200+150

= Rs. 4200+250+630+150

= Rs. 5230

VAT = 13%

VAT amount = 13 % of Rs. 5230

= 13/100 × 5230

= Rs. 679.90

Price with VAT to be paid by costumer,

= Rs. 5230 + 679.90

= Rs. 5909.90

Radha purchased item at 5% discount if discount amount is rs 74 at what price did she purchase the item

ReplyDeleteSolution: Here,

DeleteDiscount = 5%

Discount amount = Rs. 74

i.e. 5% of MP = Rs. 74

or, 5/100 × MP = Rs. 74

or, 1/20 × MP = Rs. 74

or, MP = Rs. 74 × 20

or, MP = Rs. 1480

Now, SP = MP – Discount amount

= Rs. 1480 – 74

= Rs. 1406 Ans.

∴ She purchased the item at Rs. 1406.

The marked price of an electric heater is Rs 3,000. What will be the price of the heater if 13 % VAT is levied after allowing 12 % discount on it?

ReplyDeleteThe solution to this question is similar to the worked-out example 2 above in the article.

DeleteThe marked price of a calculator is Rs 1,800. The shopkeeper allows 10 % discount and still makes 8 % profit. At what price did the shopkeeper purchase

ReplyDeletethe calculator?

The solution to this question is similar to the worked-out example 7 above in the article.

DeleteThe marked price of a woolen sweater is Rs 1,750. If the shopkeeper allows 20 % discount and makes a profit of Rs 150, at what price did he purchase the sweater?

ReplyDeleteThe solution to this question is similar to the worked-out example-7 above in the article.

DeleteUse "CP = SP – profit" instead of the CP formula used in the solution of example7.

The marked price of an article is Rs 2,800 which is 40 % above the cost price. If it

ReplyDeleteis sold by allowing 20 % discount, what will be the profit percent?

Solution: Here,

DeleteMP = Rs. 2800

Discount = 20%

SP = (100 – d%)/100 × MP

= (100 – 20)/100 × 2800

= 80 × 28

= Rs. 2240

MP is 40% above the CP

i.e. CP + 40% of CP = MP

or, CP + 40CP/100 = Rs. 2800

or, CP(1 + 2/5) = Rs. 2800

or, CP × 7/5 = Rs. 2800

or, CP = Rs. 2800 × 5/7

or, CP = Rs. 2000

Profit = SP – CP = Rs. 2240 – 2000 = Rs. 240

Profit% = Profit/CP × 100%

= 240/2000 × 100%

= 12% Ans.

A retailer bought a watch for Rs 2,500 and he labelled its price 20 % above the cost

ReplyDeleteprice. If he allows 10 % discount to a customer, find his profit percent.

Solution: Here, CP = Rs. 2500

DeleteMP = CP + 20% of CP

= Rs. 2500 + 20/100 × 2500

= Rs. 2500 + 500

= Rs. 3000

Discount = 10%

SP = MP – 10% of MP

= Rs. 3000 – 10/100 × 3000

= Rs. 3000 – 300

= Rs. 2700

Profit = SP – CP = Rs. 2700 – 2500 = Rs. 200

Profit% = Profit/CP × 100%

= 200/2500 × 100%

= 8% Ans.

Mr. Rai bought a radio for Rs 2,000 and fixed its price so that after giving 20 %

ReplyDeletediscount he made 10 % profit. Find the fixed price of the radio.

Solution: Here,

DeleteFixed Price = MP = ?

CP = Rs. 2000

Profit = 10%

SP = (100 + P%)/100 × CP

= (100+10)/100 × 2000

= 110/100 × 2000

= Rs. 2200

Discount = 20%

MP = 100/(100 – d%) × SP

= 100/(100 – 20) × 2200

= 100/80 × 2200

= 2750

∴ Fixed Price = Rs. 2750

Mr. Jha purchased a bicycle costing Rs 5,600 from a dealer at 5 % discount and

ReplyDeletesold at a profit of 10 %. If he had sold it at 5 % discount, find its marked price.

Solution: Here,

DeleteCP = Rs. 5600 – 5% of 5600

= Rs. 5600 – 280

= Rs. 5320

Profit = 10%

SP = [(100 + P%)/100] × CP

= [(100 + 5)/100] × 5320

= [105/100] × 5320

= Rs. 5586

Discount = 5%

MP = [100/(100 – d%)] × SP

= [100/(100 – 5)] × 5586

= [100/95] × 5586

= Rs. 5880

∴ Marked price is Rs. 5880. Answer.

) A trader marks the price of his/her goods 40 % above the cost price and allows

ReplyDelete20% discount. If his/her purchase price of an item is Rs 6,000, how much should

a customer pay for it levying 13 % VAT?

The cost price of an electric fan is Rs 2,800. If the shopkeeper marks its price 30%

ReplyDeleteabove the cost price and sells it at 10 % discount, how much should a customer

pay for it with 15 % VAT?

d) The marked price of an electric item is Rs 2,400 and the shopkeeper allows 20%

ReplyDeletediscount. After levying VAT, if a customer pays Rs 2,208 for it, find the VAT

percent.

) The marked price of an article is Rs 4,500. After allowing some percent of discount

ReplyDeleteand levying 10 % VAT it is sold at Rs 4,400, find the discount percent.

8. a) A grocer fixed the price of his goods 25 % above the cost price. If he/she sold a box

ReplyDeleteof noodles allowing 5 % discount, find his profit percent.

b) Rabi Sahu fixed the marked price of his radio to make a profit of 30 %. Allowing

15 % discount on the marked price, the radio was sold. What percent profit did he

make?

c) The marked price of a watch is 30 % above the cost price. When it is sold allowing

ReplyDelete20 % discount on it, there is a gain of Rs 150. Find the marked price and the cost

price of the watch.

d) A trader fixed the price of cosmetic items 30 % above the cost price. When he/she

sold an item at 25 % discount, there was a loss of Rs 15. Find the cost price and

marked price of the item.

8.C no

DeleteSolution:

DeleteHere,

CP = Rs. x (let)

MP = CP + 30% of CP = x + 30x/100 = 130x/100 = 13x/10

Discount = 20%

SP = [(100 – d%)/100] × MP = [(100 – 20)/100] × 13x/10 = 80/100 × 13x/10 = 52x/50

Profit = Rs. 150

i.e. SP – CP = 150

or, 52x/50 – x = 150

or, 2x/50 = 150

or, 2x = 7500

or, x = 7500/2

or, x = 3750

∴ MP = 13x/10 = 13×3750/10 = Rs. 4875

∴ CP = x = Rs. 3750

e) The selling price of an article is 20 % less than its marked price and the marked

ReplyDeleteprice is 30 % above the cost price. Find the profit percent.

f) The marked price of a radio is 25 % above the selling price and the cost price is

30 % less than its marked price. Find the discount percent and gain percent.

g) Mrs. Sharma fixed the price of a pen to make a profit of 10 %. But she sold it

ReplyDeleteallowing a discount of Rs 7.50 and lost 5 %. At what price did she purchase the

pen?

9. a) When an article is sold at a discount of 10 %, a profit of Rs 8 is earned. If the same

ReplyDeletearticle is sold without allowing a discount, there will be a profit of Rs 20. Find the

cost price of the article.

b) A watch was sold on its marked price at a gain of 20 %. But allowing 5 % discount,

there would have been a gain of Rs 140. Find the cost price of the watch.

c) A shopkeeper sold an article at 20 % discount and made a loss of Rs 90. If he had

ReplyDeletesold it at 5 % discount, he would have gained Rs 90. Find the cost price and the

marked price of the article.

d) An article, after allowing a discount of 20 % on its marked price, was sold at a gain

of 20 %. Had it been sold after allowing 25 % discount, there would have been a

gain of Rs 125. Find the marked price of the article.

10. a) A bicycle is sold at Rs 9,040 after allowing 20 % discount and imposing 13 % VAT.

ReplyDeleteFind the marked price of the bicycle.

b) After allowing 15 % discount on the marked price of an article 13 % VAT was

levied on the remaining amount, then the price of the article becomes Rs 13,447.

Find the marked price of the article.

c) The marked price of an article is Rs 4,000. If the price of the article including

ReplyDelete13 % VAT is Rs 3,616, find the discount percent given in it.

d) A colour TV is sold at Rs 20,700 after 10 % discount with 15 % VAT. Find the VAT

amount.

e) After allowing 10 % discount on the marked price of an article and then 15 %

VAT is charged, its price becomes Rs 16,720. How much amount was given as

discount?

10.e. ans please fast at halfan hour😀😀😀😀

Delete11. a) A shopkeeper purchased a bicycle for Rs 5,000 and marked its price a certain

ReplyDeletepercent above the cost price. Then, he sold it at 10% discount. If a customer paid

Rs 6,356.25 with 13% VAT to buy it, how many percent is the marked price above

the cost price?

b) The price of an article is fixed a certain percent above the cost price and sold it at

5% discount. If the cost price of the article is Rs 16,000 and sold it for Rs 20,064

with 10% VAT by how many percent is the marked price above the cost price?

12. a) When an article was sold at a discount of 10%, a customer paid Rs 9,153 with

ReplyDelete13% VAT. If 8% profit was made in this transaction by how many percent was the

marked price above the cost price?

b) A retailer marked the price of a mobile a certain percent above the cost price. Then,

he allowed 20% discount to make 12% profit. If the mobile was sold for Rs 5,062.40

with 13% VAT, by what percent is the marked price above the cost price?

13. a) After allowing 25 % discount on the marked price and then levying 10 % VAT, a

ReplyDeletecycle was sold. If the discount amount was Rs 750, how much VAT was levied on

the price of the cycle?

b) A tourist buys a Nepalese flag at a discount of 15 % but pays 10 % VAT. If he/she

pays Rs 170 for VAT, calculate the discount amount.

c) A person buys an article at a discount of 13 % and pays 16 % VAT. If he/she pays

ReplyDeleteRs 261 for VAT, find the marked price of the article and also the amount paid by

him/her to buy the article.

d) After allowing 20% discount on the marked price of a mobile, 15% VAT was levied

and sold it. If the difference between the selling price with VAT and selling price

after discount is Rs 1,800, find the marked price of the mobile.

14. a) In the peak season of winter days, a retailer marked the price of an electric heater

ReplyDeleteas Rs 4000 and 10% discount was given to make 20% profit. But in the summer

days she/he increased the discount percent to get only 12% profit from the same

type of heater. How much did she/he increase the discount percent?

b) The marked price of a mobile set is Rs 9,600 and 40% discount is allowed to make

20% profit. By what percent is the discount to be reduced to increase the profit by

10%?

4a) Solution∶

DeleteCase I

M.P =Rs.4000

Discount =10%

Profit =20%

S.P1 =M.P-D% of M.P

=Rs.4000-10/100*Rs4000

=Rs.4000-Rs.400=Rs.3600

S.P1=C.P+P% of C.P

or,Rs.3600=C.P+20% of C.P

or,Rs.3600=C.P+20/100*C.P

or,Rs.3600=(100C.P+20C.P)/100

or,Rs.3600 =(120C.P)/100

or,Rs.3600*100/120=C.P

C.P =Rs.3000

Case II

M.P =Rs.4000

C.P =Rs.3000 =

profit =12%

Type equation here.

S.P2=C.P+P% of C.P

=Rs.3000+12%*Rs.3000

=Rs.3000+12/100*Rs.3000

=Rs.3000+12*Rs.30

=Rs.3000+Rs.360

=Rs.3360

Discount =(M.P-S.P2)/(M.P)*100%

=(Rs.4000-Rs.3360)/(Rs.4000)*100%

=16%

Incresing Discount percent =16%-10%=6% Ans.

15. a) discount to make 20% profit. If she/he increased the discount to 25%, by how

ReplyDeletemuch was the profit percent decreased?

A retailer allowed 4% discount on her/his goods to make 20% profit and sold

a refrigerator for Rs 10,848 with 13% VAT. By how much is the discount to be

increased so that she/he can gain only 15%?

b) A supplier sold a scanner machine for Rs 41,400 with 15% VAT after allowing

10% discount on it's marked price and gained 20%. By how much is the discount

percent to be reduced to increase the profit by 4%?

Please send this solution

DeleteQuestion:

DeleteA retailer allowed 4% discount on her/his goods to make 20% profit and sold

a refrigerator for Rs 10,848 with 13% VAT. By how much is the discount to be

increased so that she/he can gain only 15%?

Solution: Here,

Discount = 4%

VAT = 13%

SP with VAT = Rs. 10848

MP = [100×100/(100-d%)(100+v%)]×SP with VAT

= [100×100/(100-4)(100+13)]×10848

= [100×100/96×113]×10848

= Rs. 10000

SP = [(100-d%)/100]×MP

= [(100-4)/100]×10000

= [96/100]×10000

= Rs. 9600

Now,

1st Case,

Profit = 20%

CP = [100/(100+P%)]×SP

= [100/(100+20)]×9600

= [100/120)]×9600

= Rs. 8000

2nd Case,

Profit = 15%

SP = [(100+P%)/100]×CP

= [(100+15)/100]×8000

= [115/100]×8000

=Rs. 9200

Discount = MP – SP = 10000 – 9200 = Rs. 800

Discount% = [Discount/MP] × 100%

= [800/10000]× 100%

= 8%

∴ Discount should be increased to 8%. Ans.

Question:

A supplier sold a scanner machine for Rs 41,400 with 15% VAT after allowing

10% discount on it's marked price and gained 20%. By how much is the discount

percent to be reduced to increase the profit by 4%?

Solution: Here,

Discount = 10%

VAT = 15%

SP with VAT = Rs. 41400

MP = [100×100/(100-d%)(100+v%)]×SP with VAT

= [100×100/(100-10)(100+15)]×41400

= [100×100/90×115]×41400

= Rs. 40000

SP = [(100-d%)/100]×MP

= [(100-10)/100]×40000

= [90/100]×40000

= Rs. 36000

Now,

1st Case,

Profit = 20%

CP = [100/(100+P%)]×SP

= [100/(100+20)]×36000

= [100/120)]×36000

= Rs. 30000

2nd Case,

Profit = 20+4% = 24%

SP = [(100+P%)/100]×CP

= [(100+24)/100]×30000

= [124/100]×30000

=Rs. 37200

Discount = MP – SP = 40000 – 37200 = Rs. 2800

Discount% = [Discount/MP] × 100%

= [2800/40000]× 100%

= 7%

∴ Discount should be reduced by (10 – 7)% = 3%. Ans.

15a) Solution

DeleteHere,Discount =4%

S.P with VAT =Rs.10,848

VAT=13%

S.P with VAT =S.P+VAT% of S.P

or,Rs.10,848=S.P+13% of S.P

or,Rs.10,848=S.P+13/100*S.P

or,Rs.10,848=(100S.P+13S.P)/100

or,Rs.10,848=(113S.P)/100

or,Rs.10,848*100/113=S.P

∴S.P=Rs.9,600

Now,

we know that

S.P =M.P-D% of M.P

or,Rs.9,600=M.P-4% of M.P

or,Rs.9,600=M.P-4/100*M.P

or,Rs.9,600=(100M.P-4M.P)/100

or,Rs.9,600*100 =96M.P

or,Rs.960000/96=M.P

∴M.P=Rs.10000

Case I

Profit =20%

S.P with out VAT=Rs.9,600

We know that

S.P =C.P+P% of C.P

or,Rs.9,600 =C.P+20% of C.P

or,Rs.9,600=C.P+20/100*C.P

or,Rs.9,600=(100C.P+20C.P)/100

or,Rs.9,600=(120C.P)/100

or,Rs.9,600*100/120=C.P

∴C.P =Rs.8,000

Case II

Profit =15%

C.P =Rs.8,000

We kmow that

S.P =C.P+P% of C.P

=Rs.8,000+15/100*Rs,8,000

=Rs.8,000+15*Rs.80

=Rs.8,000+Rs.1,200

=Rs.9,200

Discount =(M.P-S.P)/(M.P)*100%

=(Rs.10,000-Rs.9,200)/(Rs.10000)*100%

=( Rs.800)/(Rs.10000)*100%

=8%

Therefore,increased discount percent to gain 15% =8%-4%=4% Ans.

16. a) Mrs. Dhital makes a profit of 50% of the cost of her investment in the transaction

ReplyDeleteof her cosmetic items. She further increases her cost of investment by 25% but the

selling price remains the same. How much is the decrease in her profit percent?

b) Mr. Yadav makes a profit of 20% in the transaction of his electrical items. He

decreases his cost of investment by 4% but the selling price remains the same.

How much is the increase in his profit percent?

c) A customer goes to a shop to buy a laptop. The marked price of the laptop is

ReplyDeleteRs 57,500 excluding 15% VAT. The customer bargains with shopkeeper and

convince him for Rs 57,500 including VAT as the final cost of the laptop. Find the

amount reduced by the shopkeeper.

d) A retailer hired a room in a shopping mall at Rs 45,000 rent per month and started

a business of garments. He spent Rs 20,00,000 to purchase different garment

items in the first phase and marked the price of each item 30% above the cost

price. Then, he allowed 10% discount on each item and sold to customers. His

monthly miscellaneous expenditure was Rs 15,000 and the items of worth 10%

of the investment remained as stocks after two months. Find his net profit or loss

percent.

What is the solution of this answer

Deletethe marked price of t.v is Rs 10000.if the VAT amouny is 90% of discount amount and the price with VAT is Rs9900, find the discount amount?

ReplyDeleteSolution: Here,

DeleteMP = Rs. 10000

SP with VAT = Rs. 9900

Discount amount = x (let)

∴ VAT amount = 90% of x = 9x/10

We know,

MP – Discount amount + VAT amount = SP with VAT

i.e. 10000 – x + 9x/10 = 9900

or, – x + 9x/10 = 9900 – 10000

or, – x/10 = – 100

or, x = 1000

∴ Discount amount = Rs. 1000 Ans.

Amit bought a smart watch for Rs 23,391. If he gets 10% discount on amount Rs 2300.find the rate of vat

ReplyDeleteSolution: Here,

DeleteSP with VAT = Rs. 23391

Discount = 10%

Discount amount = Rs. 2300

∴ 10% of MP = Rs. 2300

i.e. 10/100 × MP = 2300

or, MP = 23000

SP = MP – Discount = 23000 – 2300 = Rs. 20700

VAT amount = SP with VAT – SP = 23391 – 20700 = Rs. 2691

VAT% = [VAT amount / SP] × 100%

= [2691/20700] × 100%

= 13% Ans.

A shopkeeper purchased a laptop for Rs.40000 and sold at a profit of 20% to a customer. How much did the customer pay for it with 13% VAT?

ReplyDeleteSolution: Here,

DeleteCP = Rs. 40000

Profit = 20%

SP = [(100 + P%)/100] × CP = [(100 + 20)/100] × 40000 = [120/100] × 40000 = Rs. 48000

VAT = 13%

∴ SP with VAT = SP + 13% of SP

= 48000 + 13/100 × 48000

= 48000 + 6240

= Rs. 54240

∴ Customer paid Rs. 54240. Ans.

Thank you so much

DeleteThe selling price of an article is 20 % less than its marked price and the marked

ReplyDeleteprice is 30 % above the cost price. Find the profit percent

Solution: Here,

DeleteLet, CP = x

MP is 30% above the CP,

∴ MP = CP + 30% of CP = x + [30/100] × x = x + 3x/10 = 13x/10

SP is 20% less than MP,

∴ SP = MP – 20% of MP = 13x/10 – [20/100] × 13x/10 = 13x/10 – 13x/50 = (65x – 13x)/50 = 52x/50 = 26x/25

Profit = SP – CP = 26x/25 – x = x/25

Profit % = [Profit/CP] × 100%

= [(x/25)/x] × 100%

= [1/25] × 100%

= 4% Ans.

A tourist bought a thanka for Rs678 including 13% VAT.How much rupees does he get return at the same time of leaving nepal

ReplyDeleteSolution: Here,

DeleteSP with VAT = Rs. 678

VAT = 13%

SP = [100/(100+v%)] × SP with VAT

= [100/(100+13)] × 678

= [100/113] × 678

= Rs. 600

VAT amount = SP with VAT – SP = Rs. 678 – 600 = Rs. 78

VAT is refundable for the tourist. Therefore, he will get return amount = Rs. 78 Ans.

If a tourist bought a statue of Lord buddha at a discount of 10% with 13%VAT and got Rs.1170 back for VAT at the airport, what wat the marked price?

ReplyDeleteSolution: Here,

DeleteDiscount = 10%

VAT = 13%

VAT amount = Rs. 1170

i.e. 13% of SP = Rs. 1170

or, 13/100 × SP = 1170

or, SP = 1170 × 100/13

or, SP = Rs. 9000

MP = [100/(100 – d%)] × SP

= [100/(100 – 10)] × 9000

= [100/90] × 9000

= Rs. 10000 Ans.

The price of a laptop is fixed 20% above its cost price and sold it at 13% discount to gain Rs.1980. How much a customer pay for it?

ReplyDeleteSolution: Here,

DeleteCP = x (let)

MP = CP + 20% of CP = x + 20/100 × x = 120x/100 = 6x/5

Discount = 13%

SP = [(100 – d%)/100] × MP = [(100 – 13)/100] × 6x/5 = [87/100] × 6x/5 = 261x/250

Profit = Rs. 1980

i.e. SP – CP = Rs. 1980

or, 261x/250 – x = 1980

or, 11x/250 = 1980

or, 11x = 495000

or, x = 495000/11

or, x = 45000

SP = 261x/250 = 261×45000/250 = Rs. 46980

∴ A customer paid Rs. 46980 for it. Ans.

After allowing 10% discount on the marked price of an article and then 15% vat is charged , its price becomes rs 16,720. How much amount was given as discount?

ReplyDeleteSolution: Here,

DeleteDiscount = 10%

VAT = 15%

SP with VAT = Rs. 16720

MP = [100×100/(100-d%)(100+v%)]×SP with VAT

=[100×100/(100-10)(100+15)]×16720

= [10000/90×115]×16720

= Rs. 16154.59

Discount amount = 10% of MP = [10/100]×16154.59 = Rs. 1615.46 Ans.

A retailer marked the price of a mobile a certain percent above the cost price. Then,

ReplyDeletehe allowed 20% discount to make 12% profit. If the mobile was sold for Rs 5,062.40

with 13% VAT, by what percent is the marked price above the cost price?

Solution: Here,

DeleteLet, CP = x

Profit = 12%

SP = [(100+p%)/100]×CP = [(100+12)/100]×x = 112x/100

Discount = 20%

MP = [100/(100-d%)]×SP = [100/(100-12)]×112x/100 = 112x/88

% above = [(MP – CP)/CP]×100%

= [(112x/88-x)/x]×100%

= [24x/88x]×100%

= 27.27% Ans.

What will be the price of a TV marked at price Rs. 5000 at discount of 15% if VAT is charged at 10% on discount price?

ReplyDeleteSolution: Here,

DeleteMP = Rs. 5000

Discount = 15%

VAT = 10%

SP with VAT = [(100-d%)(100+v%)/100×100]×MP

= [(100-15)(100+10)/10000]×5000

=[85×110/10000]×5000

= Rs. 9350 Ans.

I have problem in this question.

DeleteIf the bill amount of an article with 25 % discount and 13 % VAT comes to be Rs.1228.88,what is the marked price?

Please solve this question. Request.

Solution: Here,

DeleteBill amount (SP with VAT) = Rs. 1228.88

Discount = 25%

VAT = 13%

MP = ?

We know,

MP = [100×100/(100-d%)(100+v%)]×SP with VAT

= [100×100/(100-25)(100+13)]×1228.88

= [10000/75×113]×1228.88

= 12288800/8475

= Rs. 1450 (approx.)

The price of an article is 1200 and a customer pays 1380 with vat find the rate of vat.

ReplyDeleteSolution: Here,

DeleteMP = Rs. 1200

SP with VAT = 1380

Since there is no discount,

SP = MP = Rs. 1200

VAT amount = SP with VAT – SP = Rs. 1380 – 1200 = Rs. 180

VAT rate = [VAT amount/SP]×100%

= [180/1200]×100%

= 15%

Marked price and selling price of an item are Rs 650.00 and Rs. 677.50 respectively. If 15% discount is allowed and some VAT is charged, find the VAT percent.

ReplyDeleteSolution: Here,

DeleteMP = Rs. 650

SP with VAT = Rs. 677.50

Discount = 15%

VAT = ?

We know,

MP = [100×100/(100-d%)(100+v%)]×SP with VAT

i.e. 650 = [100×100/(100-15)(100+v%)]×677.50

or, 650/677.50 = 10000/85(100+v%)

or, 650×85(100+v%) = 6775000

or, 5525000+55250v% = 6775000

or, 55250v% = 6775000 – 5525000

or, 55250v% = 1250000

or, v% = 1250000/55250

or, v% = 22.62%

Bonus=5% VAT = 13%

ReplyDeletePAID AMOUNT = 13378

MP =?

Solution: Here,

DeleteBonus (Discount) = 5%

Paid amount (SP with VAT) = Rs. 13378

VAT = 13%

MP = ?

We know,

MP = [100×100/(100-d%)(100+v%)]×SP with VAT

= [100×100/(100-5)(100+13)]×13378

= [10000/95×113]×13378

= 13462.04

pemba bought a TV set with 13% VAT after 15% discount for Rs7,203.75.What will be actual price of TV?Also find the VATamount

ReplyDeleteSolution: Here,

ReplyDeleteVAT = 13%

Discount = 15%

SP with VAT = Rs. 7203.75

MP = [100×100/(100-d%)(100+v%)]×SP with VAT

= [100×100/(100-15)(100+13)]×7203.75

= [100×100/85×113]×7203.75

= Rs. 7500

∴ Actual Price = MP = Rs. 7500

SP = [(100-d%)/100]×MP = [(100-15)/100]×7500 = [85/100]×7500 = Rs. 6375

∴ VAT amount = 13% of SP = [13/100]×6375 = Rs. 828.75

thank u....

DeleteIf discount percentage is 10% ,vat%= 13% , vat with money is 5763 then what is m.p

ReplyDeleteSolution:

DeleteHere,

Discount = 10%

VAT = 13%

VAT amount = Rs 5763

MP = x (let)

SP = [(100 – d%)/100] × MP = [(100 – 10)/100] × x = [90/100] × x = 9x/10

VAT amount = Rs 5763

i.e 13% of SP = 5763

or, 13/100 × 9x/10 = 5763

or, 117x/1000 = 5763

or, 117x = 5763000

or, x = 5763000/117

or, x = 49256.41

∴ MP = 49256.41

A private firm bought 6 computer of marked price Rs.32000 each at a discount of 15%. If 13% vat is levied, find the amount of vat paid for each computer. also find the total amount required for buying 6 computers

ReplyDeleteA shopkeeper has to pay 7% bonus for selling some goods.If he paid rs 17500 bonus, and then 13%vat what will be marked price and the price including vat?

ReplyDeleteThis question has been already solved. Please, look at the comments above.

DeleteA shopkeeper bought a radio for Rs. 10,000 and sold at a profit of 10% to a customer with 13% VAT. How much did the customer pay for the radio?

ReplyDeleteSolution:

DeleteHere,

CP = Rs. 10,000

Profit = 10%

VAT = 13%

SP with VAT = ?

SP = [(100 + P%)/100] × CP = [(100 + 10)/100] × 10000 = Rs. 11000

∴ VAT amount = 13% of SP = [13/100] × 11000 = Rs. 1430

∴ SP with VAT = SP + VAT amount = Rs. 11000 + 1430 = Rs. 12430

∴ Customer paid Rs. 12430 for the radio.

A trader labelled his article 10% discount on the mp in such a way that he gains the profit of 45% in the sp . What is the mp

ReplyDeleteWhen a cycle is sold allowing 10% discounton

ReplyDeleteits Marked Price a seller gains St and allowing

5% discount on the profit is Rs 35 1. find the "

cost price of the cycle.

What is mean by St?

DeleteAn article is marked 25% above cost price and sold it at a discount of 10%. If the selling price of the article including 15% Vat is RS, 4500. Find the marked price and cost price

ReplyDeleteSolution:

DeleteLet, CP = Rs. x

∴ MP = x + 25% of x = x + 25x/100 = 125x/100 = 5x/4

Discount = 10%

VAT = 15%

SP with VAT = Rs. 4500

i.e. (100-D%)(100+V%)×MP/100×100 = 4500

or, (100-10)(100+15)×4500/100×100 = 4500

or, 90×115×5x/4×100×100 = 4500

or, 51750x = 180000000

or, x = 180000000/51750

or, x = 3478.26

∴ MP = 5x/4 = 5×3478.26/4 = Rs. 4347.82

∴ CP = x = Rs. 3478.26

After allowing 10%discount on the marked price and then levying 5%vat,the radio was sold on Rs.1417.5. find the marked price and vat amount.

DeleteThe marked price of a cupboard is 25% above it's cost price,when it is sold at a gain of 10%,the profit amounts to RS 840.Find the marked price of the cupboard.

ReplyDeleteSolution:

DeleteCP = Rs. x (let)

∴ MP = x + 25% of x = x + 25x/100 = 125x/100 = 5x/4

Discount = 10%

∴ SP = (100 – D%)×MP/100 = (100 – 10)×5x/4×100 = 450x/400 = 9x/8

Profit = Rs. 840

i.e. SP – CP = Rs. 840

or, 9x/8 – x = 840

or, x/8 = 840

or, x = 6720

∴ MP = 5x/4 = 5×6720/4 = Rs. 8400

A man bought two school bags for RS.2020.He sold one of them at 20% profit and the other at 20% loss.Find his gain or loss percent in this transaction if the selling prices of both bags are same.

ReplyDeleteAfter allowing 16% discount on the marked price of a watch 13% value added tax (VAT) way leived on it. If the watch was sold for Rs.4,746 , calculate the marked price of watch.

ReplyDeleteSolution:

DeleteHere,

Discount = 16%

VAT = 13%

SP with VAT = Rs. 4746

MP = ?

By formula,

MP = 100×100×SP with VAT /(100-d%)(100+v%)

= 100×100×4746/(100-16)(100+13)

= 47460000/84×113

= Rs. 5000

How much is more value including 13% VAT RS 600 than RS 650?

ReplyDeleteSolution:

DeleteHere,

Rs. 600 with 13% VAT = Rs. 600 + 13% of 600 = Rs. 600 + 78 = Rs. 678

∴ Rs. 678 – 650 = Rs. 28

∴ Rs. 28 is more.

After allowing 10% discount on the marked price of a radio, 13% VAT was levied and sold it. If the difference between the selling price with VAT and selling price after discount is Rs1170, Find the marked price of that radio.

ReplyDeleteSolution:

DeleteHere,

Discount = 10%

VAT = 13%

MP = Rs. x (let)

SP = (100 – d%)×MP/100 = (100 – 10)x/100 = 90x/100

SP with VAT = (100 – d%)(100 + v%)×MP/100×100 = (100 – 10)(100 + 13)x/10000 = 1017x/1000

ATQ,

SP with VAT – SP = Rs. 1170

i.e.

1017x/1000 – 90x/100 = 1170

or, 117x/1000 = 1170

or, 117x = 1170000

or, x = 1170000/117

or, x = 10000

∴ MP = Rs. 10000

After allowing 20% discount on the MP of a motorcycle 15% VAT was levied and sold it. If the difference between SP with VAT and SP after discount is Rs 54000. FInd the MP of motorcycle

ReplyDeleteSolution:

DeleteHere,

Discount = 20%

VAT = 15%

MP = Rs. x (let)

SP = (100 – d%)×MP/100 = (100 – 20)x/100 = 80x/100

SP with VAT = (100 – d%)(100 + v%)×MP/100×100 = (100 – 20)(100 + 15)x/10000 = 920x/1000

ATQ,

SP with VAT – SP = Rs. 54000

i.e.

920x/1000 – 80x/100 = 54000

or, 120x/1000 = 54000

or, 120x = 54000000

or, x = 154000000/120

or, x = 450000

∴ MP = Rs. 450000

The Market Price of an article is Rs 10000 and shopkeeper allows some percent discount and adding some percent VAT which is 3% more than the discount percent. If the costumer pays RS 10170 for the article then find the VAT amount.

ReplyDeleteSolution:

DeleteHere,

MP = Rs. 10000

Discount = x% (let)

∴ VAT = x+3%

SP with VAT = Rs. 10170

SP with VAT = (100 – d%)(100 + v%)×MP/100×100

i.e.

10170 = (100 – x)(100 + x + 3)10000/10000

or, 10170 = (100 – x)(103 + x)

or, 10170 = 10300 + 100x – 103x – x2

or, 10170 = 10300 – 3x – x2

or, x2 + 3x + 10170 – 10300 = 0

or, x2 + 3x – 130 = 0

or, x2 + 13x – 10x – 130 = 0

or, x(x + 13) – 10(x + 13) = 0

or, (x + 13)(x – 10) = 0

∴ Either, x + 13 = 0 or, x = -13 (negative value rejected)

Or, x – 10 = 0 or, x = 10

∴ Discount = x = 10%

SP = (100 – d%)MP/100 = (100 – 10)10000/100 = 9000

VAT amount = SP with VAT – SP = 10117 – 9000 = Rs. 1117

If 'a', 'b' and 'c' be the SP, SP after discount, SP with VAT,

ReplyDeletewrite the relation among them.

Solution:

DeleteHere,

SP before discount = MP = a

SP after discount = SP = b

SP with VAT = c

Discount amount = MP – SP = a – b

VAT amount = SP with VAT – SP = c – b

I recently came across your blog and have been reading along. I thought I would leave my first comment. used bmw car price in new jersey

ReplyDeleteThis is an awesome motivating article.I am practically satisfied with your great work.You put truly extremely supportive data. Keep it up. use laptop sell

ReplyDeleteA shopkeeper allows same rate of discount for all articles available in his shop. If he sells a heater for Rs.8,000 marked as Rs.10,000, for what amount does he sell a mixer of marked price Rs. 3,000 levying 13% VAT on discounted price? Find it

ReplyDelete